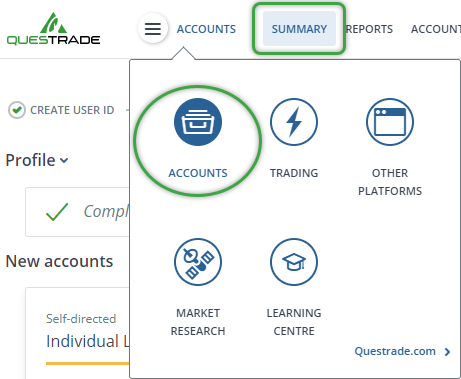

Summary

Questrade’s trading accounts come in registered account types, including popular accounts such as TFSA, RRSP, and RESP, and non-registered account types, such as individual margin accounts, all of which are offered in US dollar options.

More Details

Questrade offers a variety of registered account types and non-registered account types that most Canadian self-directed investors would find appealing to consider. Choosing the right account type and learning about account types in general is (in our opinion) one of the most important things to do first because different account types come with different conditions, costs, and possible tax consequences.

An explanation of the various account types, available on Questrade’s website, is straight-forward. Like other Canadian online stock brokers, Questrade’s trading accounts can be grouped into registered accounts and non-registered accounts. The challenging part, however, is that Questrade does offer quite a few different account types, so for now, we’ll stick to reviewing the most popular Questrade account types.

In terms of popular registered accounts, Questrade offers the Tax Free Savings Account (TFSA), Registered Retirement Savings Plan (RRSP), Registered Education Savings Plan (RESP), and Registered Retirement Income Fund (RRIF). To learn more about the registered account types at Questrade for self-directed investing, head to their website here.

The most popular non-registered account types at Questrade are individual margin accounts, which enable you to borrow money to trade using margin (and have to pay interest if you do borrow, of course!). A common type of investment account offered at other online brokerages is a cash account, however, Questrade does not offer cash accounts per se. If you don’t use margin, then the margin account effectively behaves like a cash account, which means that self-directed investors have to be mindful of how they enter in their trading orders so as to not accidentally incur borrowing costs.

A very important and competitive feature that Questrade offers for its account types is US dollar denominated accounts. Questrade US dollar accounts are popular because they enable self-directed investors to hold and trade securities in US dollars directly without incurring forced currency charges. Registered accounts at Questrade, such as TFSAs, RRSPs, and RESPs, are offered in US dollar options, as are non-registered margin accounts.

Knowing more about account types makes it easier to understand what kinds of investment options and opportunities you can take advantage of, so it is worth it to learn about them. The good news is that Questrade makes it easy to access and learn about account types, as well as the associated fees for different account types.